-

Call Us Now

+91 22 69112800 -

Send Mail Us

contact@sbiventures.co.in - CONSULTATION

SBI Ventures (Formerly known as SBICAP Ventures Limited) to manage ₹1,000 crore Trilateral Development Cooperation Fund of Ministry of External Affairs to scale innovations by Indian businesses

SBI Ventures Limited, (Formerly known as SBICAP Ventures Limited) the private equity arm of State Bank of India, has launched Trilateral Development Cooperation (TDC) Fund in partnership with the Ministry of External Affairs (MEA), Government of India. The TDC Fund is a Category II SEBI registered, AIF established with a corpus of ₹700 crore and a green shoe option of ₹ 300 crore.

TDC Fund, a fund-of-fund, will route MEA’s capital commitments to eligible daughter funds, starting with its investment in the GIP Fund. The GIP Fund is expected to be established as a partnership between the MEA and the Foreign, Commonwealth and Development Office (FCDO), Government of UK under the India – UK Global Innovation Partnership (GIP). SVL has been appointed as the Investment Manager of the TDC Fund and shall facilitate the GIP program for MEA.

TDC Fund – through its investment in the GIP Fund – aims to foster, transfer, and scale up demonstrated and sustainable innovations from India to select developing countries, thereby promoting their economic development, and accelerating Sustainable Development Goals. In future, the MEA could potentially utilise the TDC Fund to contribute to other AIFs, similar to the GIP Fund, established in partnership with other partner countries under the Trilateral Development Cooperation Framework.

The Economic Times Real Estate Conclave, 2024

Suresh Kozhikote, MD & CEO, SBI Ventures Ltd. (Formerly known as SBICAP Ventures Ltd.) participated in a panel discussion at the #ETRECA 2024 in Mumbai, highlighting the importance of project financing and its nuances to find an impact that counts.

“Financing your projects right!" deep dived into the best ways to finance construction projects, how to keep projects financially viable over the long run, why projects get stuck, the need for funds like SWAMIH to cater to stuck projects, and the best practices of project life-cycle management.

Mr. Kozhikote shared his insights on SWAMIH FUND’s meticulous investment approach, emphasizing robust due diligence and proactive project oversight with relevant examples.

The success stories underscore SBI Ventures’ laser-sharp focus on ensuring compliance. When coupled with its impact on the innumerable lives and livelihoods in the RE landscape, it only fortifies the vision to finance projects.

Interaction with UK Foreign Secretary James Cleverly discussing the strengthening of the UK-India relationship and other bilateral ties 28th Oct 2022 at Taj Palace,Mumbai

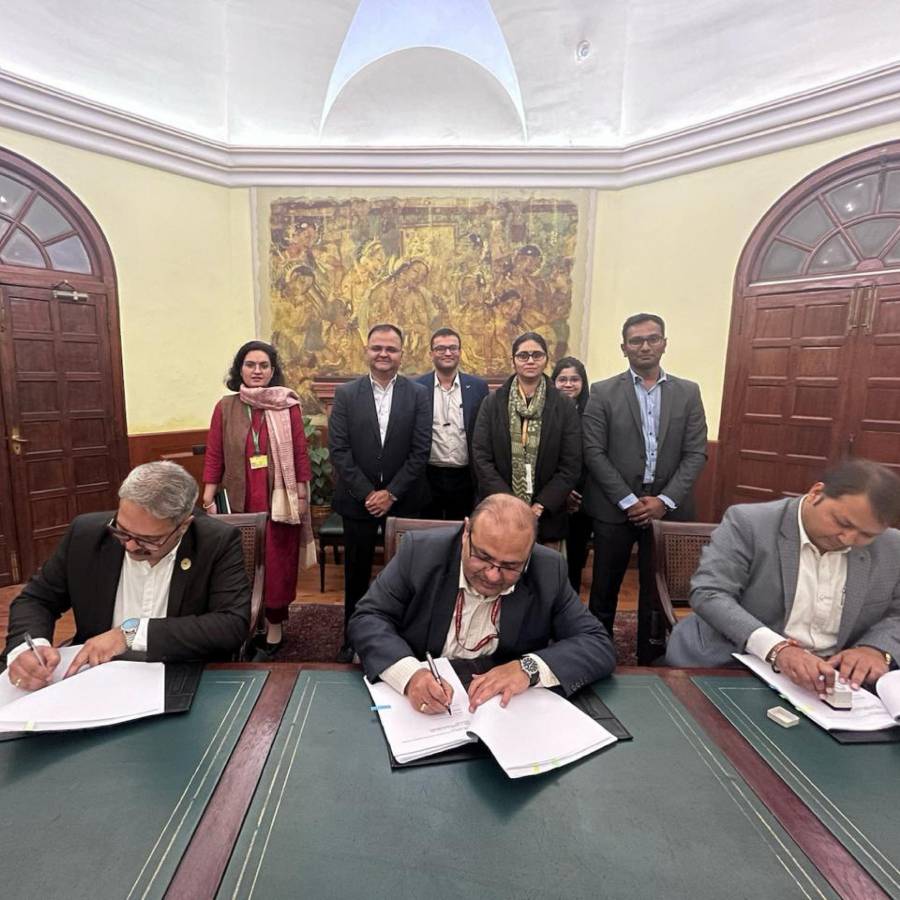

SBI Ventures Limited (Formerly known as SBICAP Ventures Limited) signed an MOU with Ministry of External Affairs, India (MEA) for establishing TRILATERAL Development Cooperation Fund (TDCF).