-

Call Us Now

+91 22 69112800 -

Send Mail Us

contact@sbiventures.co.in - CONSULTATION

1. What is SRI Fund?

In line with the vision of Prime Minister of India Mr. Narendra Modi, the Finance Minister, announced creation of a Fund of Funds (FoF) for Micro, Small and Medium Enterprises (MSMEs) under the Atmanirbhar Bharat package on the 13th May 2020, to address severe shortage being faced by MSMEs in securing growth capital. Consequently, NSIC Venture Capital Fund Limited (NVCFL), a 100% subsidiary of The National Small Industries Corporation Limited (NSIC), a Mini-Ratna Corporation of Government of India under Ministry of Micro, Small and Medium Enterprises (MoMSME), Government of India, was incorporated.

The ‘Self Reliant India (SRI) Fund’ is launched as the first scheme of NVCFL.SRI Fund will employ a ‘Fund-of-Fund’ investment strategy wherein the Fund shall invest in SEBI registered Category I and Category II Alternative Investment Funds (“Daughter Funds”), which shall in turn invest in MSMEs. The Daughter Funds shall invest at least 5 times the amount of capital contribution received from SRI Fund (net of fees and expenses) in MSMEs, defined as per the MSMED Act.

2. Who is the anchor investor in SRI Fund?

The anchor investor of the Fund is the Government of India, through the Ministry of Micro, Small and Medium Enterprises

3. Who are the sponsors for SRI Fund and what is the overall Fund corpus?

SRI Fund has been sponsored by The National Small Industries Corporation Ltd. (a mini-Ratna Corporation of the Government of India under the Ministry of Micro, Small and Medium Enterprises) anchored by its wholly owned subsidiary, NSIC Venture Capital Fund Limited. The overall Fund Corpus is Rs. 10,006 crore.

4. Who is the Investment Manager and Legal Advisor for SRI Fund?

The Investment Manager for SRI Fund is SBI Ventures Limited (formerly known as SBICAP Ventures Limited) and Legal Advisor is Khaitan & Co.

5. What is the tenure/term of SRI Fund?

Tenure of the Fund shall be 15 years which maybe extended as per AIF guidelines and subject to approvals from NVCFL and contributors.

6. What is the investment/commitment period of SRI Fund?

Investment Period for SRI Fund is 13 years.

7. What is the investment objective of SRI Fund?

SRI Fund, in the form of Fund of Funds (FoF), will be oriented towards providing funding support to the Daughter Funds for onward provision to MSMEs as growth capital, in the form of equity, quasi-equity and debt, as may be permitted under SEBI guidelines, for:

- Enhancing equity/equity like financing to MSMEs

- Supporting faster growth of MSME Businesses and thereby ignite the economy and create employment opportunities;

- Supporting enterprises which have the potential to graduate beyond the MSME bracket and become National/ International Champions;

- Supporting MSMEs which help `making India self-reliant by producing relevant technologies, goods and services.

8. Can SRI Fund invest directly in MSMEs?

No. SRI Fund can provide funds/ capital only to the Daughter Funds for onward investment in MSMEs and the investment in MSMEs will be done by the Daughter Funds only.

9. What is the definition of a Daughter Fund?

Daughter Fund would be a Category I or Category II Alternative Investment Fund (AIF) registered with SEBI, who in turn shall invest in MSME units

10. Are AIFs which have availed commitments from any of the Fund of Funds of Government of India (Central Government), like the Fund of Funds for Startups, EDF of the Ministry of Communications and Information Technology, ASPIRE etc. eligible for investment by this Fund?

Yes, subject to provisions mentioned in point no. 11 below.

11. What is the permissible commitment to be sought from SRI Fund?

Commitment sought from SRI Fund should be minimum Rs. 25 crore and in multiples of Rs. 5 crore thereafter. Maximum commitment from SRI Fund would be lower of i) 20% of the Target Corpus or ii) Rs. 2,000 crore, as illustrated below:

A. If first close is pending as on date of submission of Detailed Application Form, lower of*:

- i. 20% of the Target Fund Corpus (including green shoe option, if any)

OR - ii. 20% of Target Fund Corpus excluding commitments from any Government of India Fund of Funds scheme (including any specific end use requirement specified and fees on such commitment)

OR - iii. Rs. 2,000 crore

B. If first close or any subsequent close is completed as on date of submission of Detailed Application Form, lower of*:

- i. 20% of the incremental corpus funds to be raised by the prospective Daughter Fund until achievement of final close (including green shoe option, if any)

- ii. 20% of Target Fund Corpus excluding commitments from any Government of India Fund of Funds scheme (including any specific end use requirement specified and fees on such commitment)

OR - iii. Rs. 2,000 crore

*Provided that for prospective Daughter Fund which has availed commitments from any of the Fund of Funds of the Government of India (Central Government) or any funding support has been received by it from other Fund of Funds of Government of India (Central Government), the same will not be included in the 80% funds to be mobilized from outside investors. Provided that in case the prospective Daughter Fund has availed commitments from any of the Fund of Funds of the Central Government of India, investments that qualify as MSMEs for the purposes of complying with the requirements of SRI Fund, shall be excluded from being counted in end use requirement of any other Government of India (Central Government) Fund of Fund Scheme.

12. What is the validity period of SRI Fund commitment?

The commitment given by the SRI Fund will be valid for 18 months during which the eligible funds are required to do the first close, failing which commitment done by Mother Fund will be re-evaluated (For the purpose of this point, first close will mean the first close after commitment by SRI Fund).

13. Is there any minimum capital that Daughter Funds have to raise?

Empanelled Daughter Funds shall raise 80% additional funds from outside sources like Banks, FIs, HNIs, VCs/PEs/Institutional Investors, PSUs, Pension Funds, Foreign Developmental Institutions etc.

Daughter Funds, after being empanelled with the Fund, will mobilize funds and for each 4 units of funds so mobilized, they will be eligible to solicit 1 unit of fund, proportionately from the SRI Fund, which shall be released on a back-ended basis.

As minimum fund that can be provided by SRI Fund is Rs. 25 crore, the minimum Fund corpus of a Daughter Fund has to be Rs. 125 crore, of which they have to raise Rs. 100 crore from outside sources.

14. What shall be required minimum investment in MSMEs through the Daughter Funds?

The Daughter Funds shall invest at least 5 times the amount of capital contribution received from SRI Fund (net of fees and expenses) in MSMEs, defined as per the MSMED Act, as amended from time to time.

The Daughter Fund shall ensure that all its investee MSMEs obtain Udyam Registration. In case the same is not obtained, the investment in such investee company shall not be considered as meeting the criteria of an investment in MSME.

15. What shall be the permissible tenure/ term of Daughter Funds?

Daughter Funds shall have a maximum tenure (including extensions, if any) which is co-terminus with the remaining tenure of the SRI Fund, as permitted under the AIF regulations from time to time.

16. What shall be the permissible investment period of Daughter Funds?

Investment Period for the Daughter Funds shall be a maximum of 6 years from the date of final close of the respective Daughter Fund.

17. What shall be the Target Return for Daughter Fund?

Target Return for Daughter Fund should be higher of i) gross IRR of 12% per annum or ii) the highest rate in Indian Rupeesoffered to any other contributor in the Daughter Fund.

IRR shall be calculated using the XIRR function provided in Microsoft Excel software.

18. What shall be the Hurdle Rate for Daughter Fund?

The preferred Hurdle Rate for Daughter Fund should be higher of i) 8% per annum or ii) the highest rate offered in Indian Rupees offered to any other contributor in the Daughter Fund, Hurdle Rate should be calculated on an annual compounded basis.

19. What shall be the Management Fee for Daughter Fund?

Management fees for Daughter Fund should be lower of i) 2% per annum or ii) the lowest rate offered by any other contributor in the Daughter Fund.

20. Which is the target group for SRI Fund?

The target group for SRI Fund, through the Daughter Funds would be MSMEs, who have a marked potential to grow, but are unable to do so because their requirement for growth capital remains unfulfilled. Funds from SRI Fund should be dispersed to create an impact across the Nation and entities in farthest regions of the country can access this funding

The funding (via the Daughter Funds) would be aimed at all existing and interested MSMEs which, after assessment, are found viable, whose growth trajectory is positive, and who have a defined business plan for growth indicating positive funds flow. Previous 3 years CAGR will be considered and due weightage will be given to the respective MSMEs potential to grow.

The Fund will also factor in non-monetary aspects, in terms of employment, reduction in regional disparity, overall economic development and establishing supply chains with depth and resilience.

Non Profit institutions, NBFCs, financial inclusion sector, micro credit sector, SHGs and financial intermediaries shall not be eligible for consideration.

21. Which is the MSME definition that will be used?

MSMEs, defined as per the MSMED Act, as amended from time to time, shall be eligible for consideration, provided they have Udyam registration.

22. Is there any preferred sectoral and geographical investment focus?

Fund is to be invested in diverse sectors (e.g. traditional MSME, agriculture, pharma, auto, chemicals, etc.), forensuring healthy mix of manufacturing, services and agriculture businesses to give impetus to companies in respective segments/ industries. The scheme is aimed at promoting maximum income and job creation, across the country.

23. Are any sectors/ areas not permitted for investment?

The capital contributions made by the SRI Fund to any Daughter Fund shall not be used by such Daughter Fund for making investments in gambling, creation of obscene content, any illegal or unlawful activities and funding any non-banking financial institutions (NBFC), non-profit organisations, micro credit sector, financial inclusion sector, self-help groups and other financial intermediaries

24. What are other terms and conditions that have to be adhered to by the Daughter Funds?

Illustrative other terms and conditions to be satisfied by Daughter Funds shall include:

- The Daughter Fund shall ensure that all its investee MSMEs obtain Udyam Registration

- The Daughter Fund shall take all requisite steps to ensure compliance with provisions of the Fund Documents (to be executed with SRI Fund) and applicable regulatory and statutory requirements for the Daughter Fund including but not limited to guidelines and provisions of the AIF Regulations, applicable laws, applicable rules, regulations relating to anti-terrorism, anti-money laundering, anti-corruption or anti-bribery, and all other requirements of all Governmental Authorities or agencies and satisfy SRI Fund of the same in such manner as prescribed by NVCFL from time to time.

- The Daughter Fund shall have and/ or develop an Environmental, Social & Governance standards (“ESG”) policy/ framework for its portfolio companies

- The Daughter Fund shall carry out annual impact assessment on growth of investee MSMEs and share an annual impact assessment report within 60 days from the end of the financial year

- The Daughter Fund must participate in periodic quantitative and qualitative surveys/ interactions/ events (including pitch events) as maybe required by NSIC, NVCFL, Ministry of MSME, SRI Fund and SVL at their own cost and also ensure their relevant portfolio companies participate in such events (Funds may include appropriate clauses in their agreements with portfolio companies to this effect).

- All the directors, sponsors and senior investment team members of the Daughter Fund shall be legally eligible (i.e., not barred) to be a director or in a managerial position under Indian law and be fit and proper persons, based on the criteria specified by SEBI

- The investment manager and/ or sponsor of the Daughter Fund shall have the necessary infrastructure and manpower to effectively discharge their activities, as prescribed by SEBI

- There should be no material arrears of statutory dues and no government enquiries/ proceedings/ prosecution/ legal action pending/ initiated against the Daughter Fund/ sponsor/ investment manager/ trustee/ promoters/ directors/ partners except as indicated in application to SRI Fund

- The Daughter Fund shall only raise/ have raised/ receive commitments/ have received contribution from Eligible Person/Investor, where Eligible Person/Investor shall mean a person who:

i. complies with know- your- customer (KYC) norms stipulated by SEBI.

ii. is willing to execute necessary documentation to establish that the Eligible Person/ Investor, (i) is of good standing and repute and (ii) has not been convicted for any material offences under any applicable law. - If the Daughter Fund does not provide the required information stipulated by SRI Fund within prescribed timelines, drawdowns from SRI Fund will not be processed.

- Any Conflict of Interest shall have to be declared upfront, at the time of application and/or as-and-when it arises, to the Investment Manager

- Any other terms or conditions as may be specified by SRI Fund, NVCFL Board or Government of India

- The Detailed Application Form submitted by prospective Daughter Fund shall need to comply with the evaluation criteria of SRI Fund to be eligible for seeking funds.

25. Does the Daughter Fund need to appoint any placement agent for seeking funds from SRI Fund? Is there any placement fees payable for fund mobilised from SRI fund?

No. Only direct applications to SRI Fund are required from prospective Daughter Funds. No placement fee should be payable for funds mobilised from SRI Fund. Also, no Placement Agents have been appointed by SRI Fund.

26. What diligences will Daughter Funds undergo?

Legal due diligence shall be carried out by the Legal Advisor. Due diligence on financial, tax and integrity aspects, and any other assessment, as may be recommended/ suggested by the Investment Committee, shall be carried out by the Investment Manager through appointment of third-party agency. Any cost towards such due diligences shall be paid by the Daughter Fund directly.

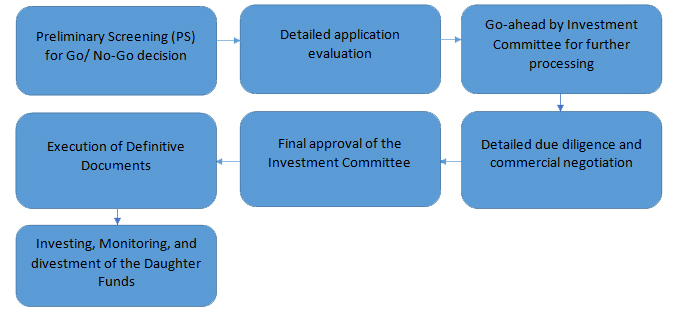

27. What are the steps involved in the investment process?

A flowchart depicting the broad investment process* is as below.

* Submitting information towards the application for SRI Fund does not guarantee commitment from SRI Fund.

28. What is the Technology platform for managing investments of SRI Fund?

The Fund/ Investment manager has created a technology platform for managing all investment related activities of SRI Fund online. In case the Fund has submitted any information for SRI Fund in manual form or over emails, the Fund shall be required to update the information on the technology platform as may be required by SVL. Daughter Funds empaneled with SRI Fund shall be required to pay fee towards access of such technology platform.

29. How can a prospective Daughter Fund apply to seek commitments from SRI Fund ?

A prospective Daughter Fund can express its interest in raising funds/ seeking investment from SRI Fund by accessing application form through technology platform.

Click here to access online application for prospective Daughter Funds – https://srifund.sbiventures.co.in/sbi_webform/

The Daughter Fund will be given an opportunity to present their proposal to the Investment Committee. The format of the presentation shall be provided to the prospective Daughter Funds.

30. Is a prospective Daughter Fund on rejection by SRI Fund, allowed to reapply for seeking commitments from SRI Fund?

Any future application from such fund for raising commitments from SRI Fund can only be initiated after a period of 6 months from date of intimation of rejection.

31. What is the reporting requirement for Daughter Fund?

Reporting requirements shall cover matters including but not limited to:

- Annual and quarterly reports of the Daughter Funds

- Quarterly information for each investment, Statement for each contributor of Daughter Funds, Annual report on impact assessment

- Valuation reports, tax returns and compliance statements

- Report on any material breach – anti corruption/ anti money laundering, environmental, social& business integrity

- Periodic report on compliance with SEBI, Companies Act and other relevant regulations

Note:The above FAQs are only indicative and are not binding on SRI Fund, SVL and/or its Legal Advisor. Please refer to the Operating guidelines for full details.